Bitcoin Metrics on Binance Show Shift That Could Precede Market Squeeze

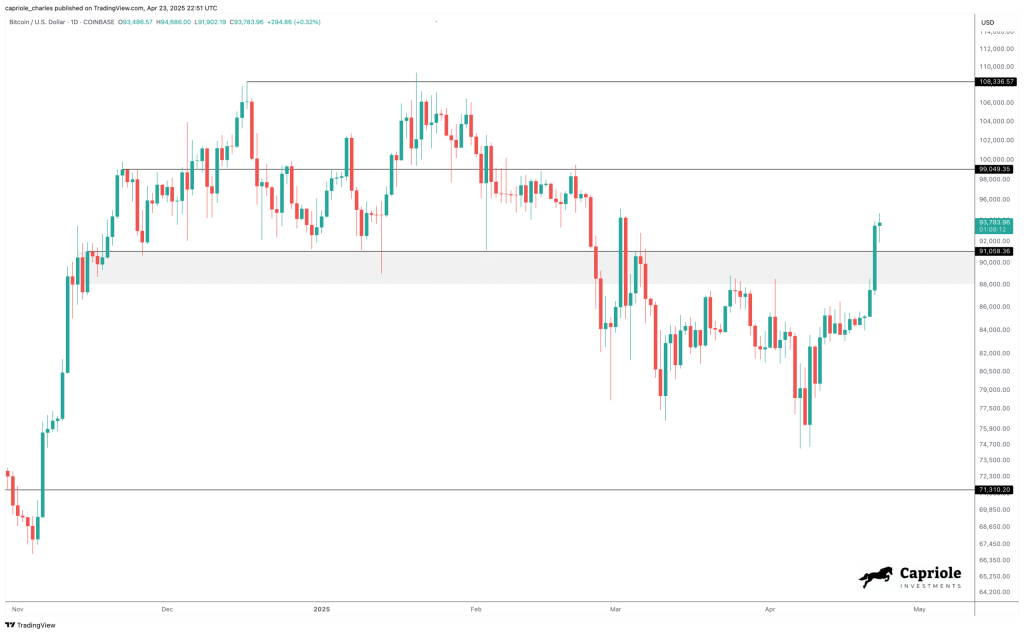

Bitcoin has seen a modest decline in price after climbing above $94,000 earlier in the week. At the time of writing, BTC is trading at $92,775, reflecting a 1.3% decrease over the past 24 hours.

The move comes after a multi-day rally that saw Bitcoin gain nearly 10% since the beginning of the week, raising questions about whether the recent momentum is sustainable or a temporary uptick amid broader market uncertainty.

While price action has stalled slightly, on-chain data and exchange behavior are beginning to shape a clearer narrative for Bitcoin’s short-term outlook.

Shift in Exchange Flows Signals Accumulation and Reduced Selling Pressure

According to a new analysis from CryptoQuant contributor Novaque Research, investor behavior on Binance, currently one of the largest retail-focused crypto exchanges, may offer valuable insight into what comes next for BTC, particularly regarding liquidity conditions, positioning, and potential short-term price squeezes.

Novaque Research pointed to notable changes in exchange flow patterns that appear to coincide with Bitcoin’s recent price behavior. Between April 6 and April 10, Bitcoin inflows into Binance exceeded 15,000 BTC.

During this same period, Bitcoin’s price hovered in the $85,000 to $87,000 range. The analysts interpret this as indicative of increased sell-side pressure , likely driven by short-term traders liquidating positions or preparing for tax-related obligations.

In contrast, between April 19 and April 23, Binance experienced over 15,000 BTC in outflows as the price moved above $93,000. This activity suggests a shift toward accumulation, with investors moving assets into self-custody—a trend often viewed as bullish since it implies reduced short-term selling risk.

Supporting this view, the Exchange Reserve metric shows a declining trend since April 18, while the Exchange Whale Ratio fell below 0.3 on April 23, suggesting that large-volume traders are stepping back, and the market is becoming more influenced by retail behavior .

Bitcoin Short Squeeze Potential Emerges as Leverage and Whale Activity Decline

Alongside changes in exchange flows, Novaque Research notes that the structure of Bitcoin’s leveraged positions has also evolved. According to the analysis, leveraged long positions were largely flushed out in the $82,000 to $88,000 range, indicating that many short-term traders exited during the recent price swings.

At the same time, short positions remain concentrated just above the $92,000 level, which could make them vulnerable to a short squeeze if the market gains further upward momentum .

The report concludes that market conditions are now more balanced, with fewer large players influencing price direction and thinner liquidity zones above current levels. The CryptoQuant contributor noted:

With the market structure cleaned up and liquidity thin above present levels, any trigger (ETF flows, Fed pivot , EM weakness) may rapidly propel BTC above $98K-$100K.

Featured image created with DALL-E, Chart from TradingView

Bitcoin Price Prediction: The Last Leg-Up That Confirms A Resounding Rally To $150,000

A new Bitcoin price prediction suggests that the flagship cryptocurrency needs just one more leg up ...

Ghost Town Vibes: Bitcoin Soars On ETFs, Not Users – Expert

Bitcoin this week reclaimed the $94,000 region, but the party may be lacking one key ingredient: rea...

Bitcoin Trades At 40% Discount As ‘Triple Put’ Unfolds: Hedge Fund Founder

Bitcoin is changing hands at prices almost 40% below its modeled “energy value,” yet an unusual conf...