REX Shares Launches First-Ever Bitcoin Corporate Treasury Convertible Bond ETF

Favorite

Share

Scan with WeChat

Share with Friends or Moments

REX Shares has announced the launch of the first-ever Bitcoin Corporate Treasury Convertible Bond ETF (BMAX).

The recently launched financial instrument aims to grant investors exposure to convertible bonds issued by companies like MicroStrategy (now Strategy), which adopts Bitcoin as a treasury asset.

In a

press release

today, REX Shares highlighted a strategy pioneered by Michael Saylor, the Executive Chairman at Strategy. The approach requires public companies to raise funds via the issuance of convertible bonds to purchase Bitcoin for their treasury.

Last year, Strategy

highlighted

this approach as part of its plan to raise $42 billion to purchase Bitcoin. With more public companies utilizing this approach, REX Shares rolled out the BMAX ETF to grant investors simplified access to these bonds.

BMAX Features

Greg King, founder and CEO at REX Shares, highlighted the uniqueness of the BMAX ETF in a statement. According to him, this is the first ETF that grants retail investors and financial advisors access to convertible bonds of companies leveraging Bitcoin as a treasury asset.

Prior to the launch of BMAX, King emphasized that investors had faced significant challenges accessing these bonds. However, with its inception, the ETF has eliminated the barrier, making investment in such bonds easier.

The press release mentioned that the BMAX ETF offers a unique blend of equity upside and debt stability. This indicates that BMAX investors will enjoy protection–akin to traditional debt–with the potential for price appreciation if BTC rallies.

“Instead of navigating the complexities of Bitcoin ownership, BMAX offers a streamlined, regulated way to engage with this market, granting investors indirect exposure to BTC via a more conservative way,”

the announcement read.

Public Companies Adopting Bitcoin as a Treasury Asset

Since Strategy adopted Bitcoin as a treasury reserve asset in 2020, several public companies have adopted the approach. Some of these include

Marathon

, Metaplanet, and

Nuvve

.

According to the announcement, the BMAX ETF will only expose investors to convertible bonds of public companies that adopt Bitcoin as a reserve asset.

REX Share is an established provider of ETFs and ETNs, boasting an AUM of over $6 billion. In addition to the BMAX ETF, the company seeks to launch other crypto-related exchange-traded funds in the United States.

In January, it submitted multiple applications to the SEC to launch seven ETFs tracking the performance of crypto assets like XRP, SOL, BTC, BONK, DOGE, ETH, and TRUMP.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/493986.html

Previous:交易员格格:3.15比特币以太坊行情解析 姨太箱体能否向上破

Next:加密生存守则:熊市撸毛,牛市炒币

Related Reading

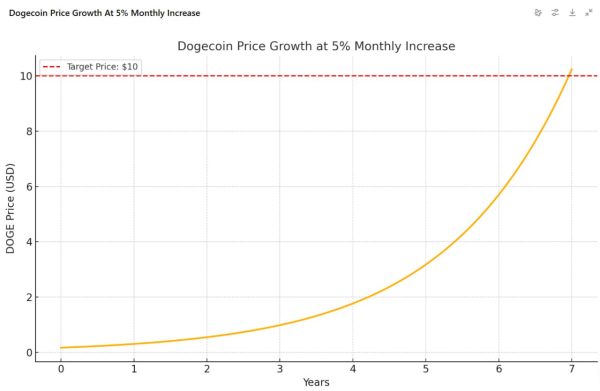

Here is When Dogecoin Can Reach $10 If It Rises only 5% Monthly

The price of Dogecoin could rise to $10 within the next few years if DOGE experiences a steady growt...

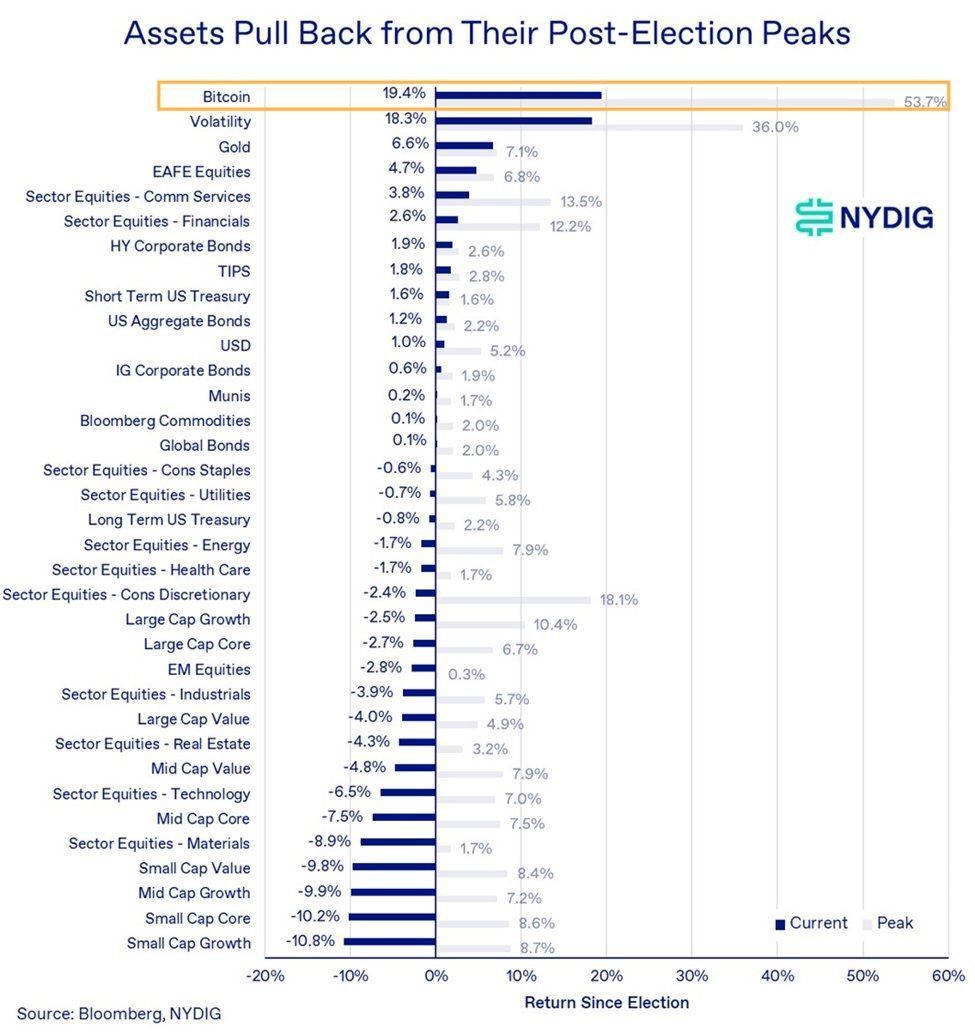

Citigroup Says Bitcoin Resilience in Turbulence Highlights Its Asset Class Value

According to a report by Citigroup, the performance of Bitcoin during recent financial turbulence sh...

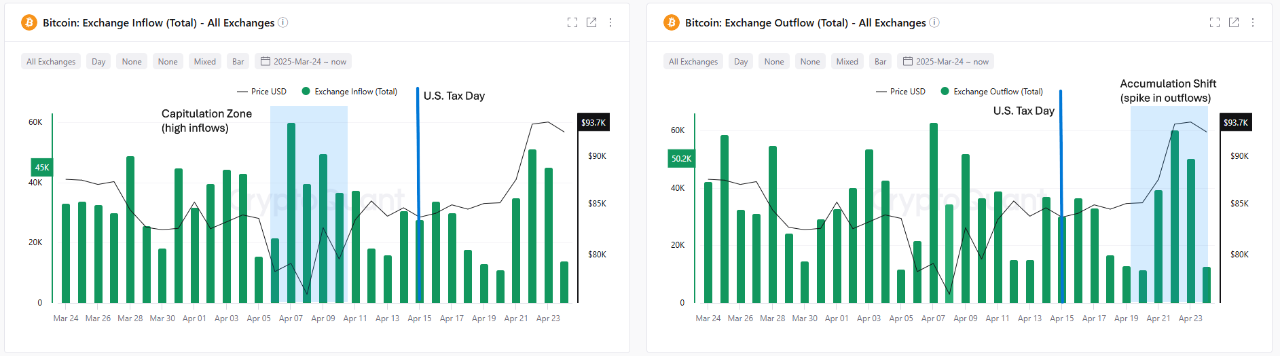

Bitcoin Short Squeeze Looms Amid Spike in Short Positions as Liquidity Builds Around $97K to $100K

The crypto market is currently on high alert as signs point to an imminent Bitcoin short squeeze ami...