Bitcoin ETFs Record Third-Highest Inflows of 2025 as Prices Surpass $94,000

- Bitcoin ETFs saw $1.4B inflows in 3 days, signaling renewed institutional confidence.

- Bitcoin rallies 25% since April low, driven by safe-haven demand and ETF inflows.

- April 21 marked the largest Bitcoin ETF inflow since January, led by ARKB and FBTC.

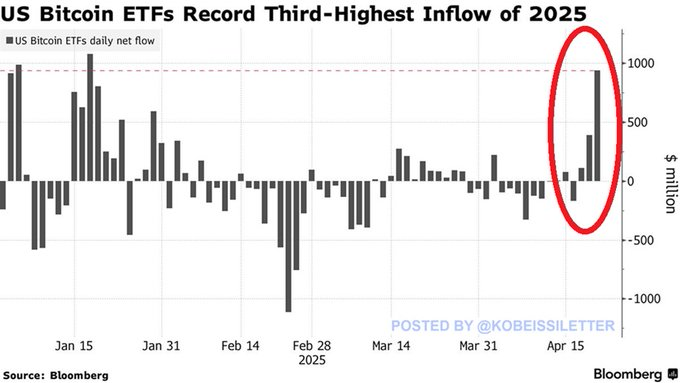

Investor demand for Bitcoin exchange-traded funds (ETFs) surged this week, with U.S.-listed Bitcoin ETFs registering $936 million in net inflows on Tuesday, marking the third-largest single-day inflow in 2025. Over the past three days, total inflows have reached $1.4 billion, coinciding with a 25% rebound in Bitcoin’s price since early April.

Bitcoin was trading above $94,000 on Tuesday, recovering from its April 7 low of $74,773. The inflows and price movement suggest a possible shift in investor behavior, with Bitcoin now drawing interest as a haven rather than merely a speculative asset.

ETF Flow Patterns Show a Clear Shift

Bloomberg data shows that Bitcoin ETF flows were characterized by high volatility earlier in the year. January saw rapid swings between positive and negative flows, with several net outflows exceeding $500 million. ETFs recorded consistent daily outflows between late January and February, reflecting broader uncertainty in crypto and traditional markets.

By March, flows began stabilizing, although daily changes remained relatively small. Small inflows and outflows dominated until mid-April, when a sharp spike appeared. On a single day, inflows crossed the $900 million mark, a shift that Bloomberg highlighted with a red circle on the 2025 flow chart.

This recent spike marks a break from the subdued trading patterns that persisted during March and early April. Analysts suggest that the renewed surge reflects stronger institutional engagement and renewed confidence in Bitcoin-linked investment vehicles.

Safe Haven Demand Supports Bitcoin’s Rally

Bitcoin reached above $94,000 after experiencing its April price low because investors rapidly increased their ETF investments. Market prices rose dramatically when Bitcoin dropped below $100,000 after U.S. President Donald Trump threatened a trade war in February. The market changes led to worldwide equity market disturbances, which then reduced crypto market value.

The joint movement of Bitcoin’s rising price and renewed ETF interest suggests a growing perception of Bitcoin as a possible hedge during periods of market stress. For the first time in 2025, Bitcoin appears to be decoupling from other risky assets, driven by safe-haven demand.

April 21: A Notable Day for ETF Inflows

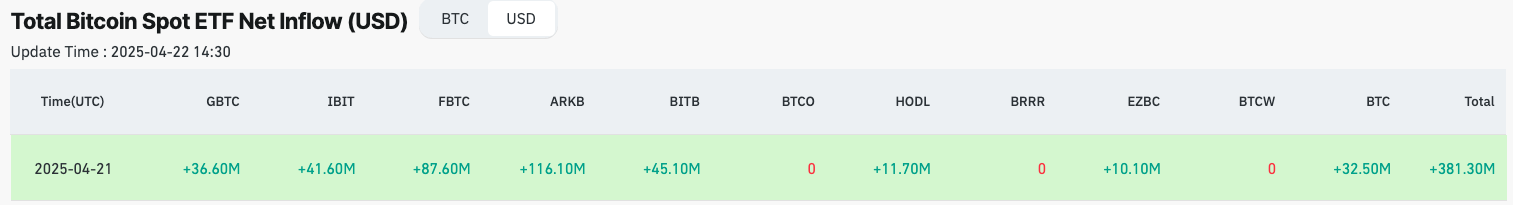

Additional momentum was recorded during the Easter weekend, particularly on April 21, when Bitcoin ETFs saw their largest single-day inflow since January 30. According to CoinGlass data, the 11 Bitcoin-tracking ETFs collectively posted a net inflow of $381.3 million.

The ARK 21Shares Bitcoin ETF (ARKB) led the day with a $116.1 million inflow. Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed, attracting $87.6 million. Grayscale’s Bitcoin Trust (GBTC) and Bitcoin Mini Trust ETF (BTC) recorded a combined net inflow of $69.1 million.

The activity on April 21 was the most significant since late January, when Bitcoin ETFs posted a $588.1 million net inflow shortly after Bitcoin briefly surpassed six figures.

Broader Context Behind the Surge

At the start of 2025, Bitcoin ETFs faced difficulties sustaining positive investment flow mainly because of political turbulence and economic market instability. Market reactions to White House tariff announcements caused major value drops in stocks and cryptocurrencies while damaging investor attitudes.

Bitcoin ETF investments experienced increased flows during April because investors regained their market confidence after resolving and stabilizing previously disruptive events.

Bitcoin Whales Realize Over $343 Million in Profits as Price Surges Above $94,000

Bitcoin ($BTC) whales realized $343M in profits as BTC crossed $94K, while network activity and exch...

DeFi Platforms Drive Ethereum Fee Burns as Network Usage Holds Steady

DeFi projects burned 1,315 ETH worth $2.38M between April 20-27, 2025, highlighting decentralized fi...

Top 10 Performers of the Week: VIRTUAL, BRETT, TRUMP, SUI, & WLD Take the Lead

For those looking for the next big crypto, this week’s market action showcases some top gainers wort...